|

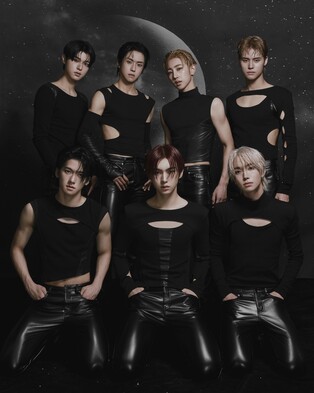

| ▲ In this photo provided by the Bank of Korea, the central bank's monetary board holds a rate-setting meeting at its headquarters in Seoul on May 25, 2023.(PHOTO NOT FOR SALE) |

|

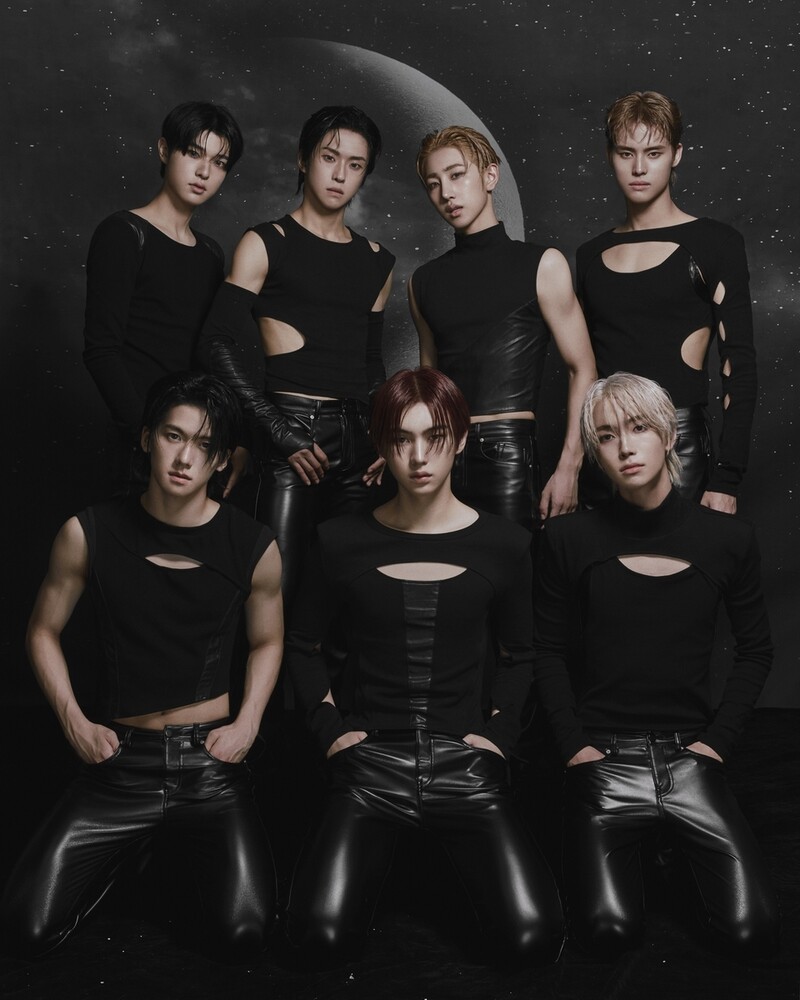

| ▲ In this file photo, containers for export are stacked at a pier in South Korea's largest port city of Busan, 320 kilometers south of Seoul, on May 10, 2023. (Yonhap) |

(2nd LD) BOK-rate freeze

(2nd LD) BOK again stands pat on rates, trims growth estimate amid slowdown woes

(ATTN: RECASTS headline, lead; ADDS growth outlook in para 5)

SEOUL, May 25 (Yonhap) -- South Korea's central bank held its key interest rate steady for the third straight time Thursday as it trimmed this year's growth estimate in the face of an extended slowdown in exports amid moderating inflation.

In a widely expected decision, the monetary policy board of the Bank of Korea (BOK) kept the benchmark seven-day repo rate unchanged at 3.5 percent.

This marked the third straight time that the BOK has stood pat following a rate freeze in February and another in April. The rate freezes came after the BOK had delivered seven consecutive hikes in borrowing costs since April last year.

The back-to-back rate freezes are raising expectations that the BOK might be ending its aggressive rate hike amid signs of moderating inflation, rising economic slowdown woes.

The central bank also lowered its growth outlook for Asia's fourth-largest economy to 1.4 percent from a 1.6 percent expansion predicted three months earlier. The BOK maintained its inflation forecast for the year at 3.5 percent.

South Korea's consumer prices grew at the slowest pace in more than a year in April in the latest signal that inflation has receded.

Consumer prices, a key gauge of inflation, rose 3.7 percent last month from a year earlier, compared with a 4.2 percent on-year rise in March, marking the first time in 14 months that the on-year inflation growth fell below 4 percent.

Though inflation appears to be moderating, the country's economy is showing signs of slowing down too, with exports, the country's major growth engine, sharply shrinking in the face of less demand in major markets.

The country's outbound shipments fell for the seventh consecutive month in April due mainly to sagging global demand for semiconductors amid an economic slowdown.

The decline in exports last month came as exports of semiconductors, the country's key export item, sank 41 percent on-year on falling demand and a drop in chip prices.

Exports have logged an on-year fall since October last year amid aggressive monetary tightening by major economies to curb inflation and an economic slowdown. It is also the first time since 2020 that exports have declined for seven months in a row.

Thursday's freeze also comes even though the rate difference with the United States is widening. Higher rates in the U.S. are feared to prompt money outflows from here, thereby weakening the local currency against the dollar and exerting upward inflation pressure by making imports more expensive.

Earlier this month, the Federal Reserve raised its benchmark rate by a widely expected quarter point to a 5 percent to 5.25 percent range, possibly the last in its policy firming.

The Fed started its aggressive campaign of rate hikes in March last year to tame inflation.

(END)

(C) Yonhap News Agency. All Rights Reserved

![[풀영상] 영화 '하트맨' 제작보고회|권상우 Kwon Sangwoo·문채원 Moon Chaewon·박지환 Park Jihwan·표지훈 피오 P.O|HEARTMAN](/news/data/20251211/p179554806839266_806_h.jpg)

![[가요소식] 지코, 요아소비 이쿠라와 신곡](/news/data/20251212/yna1065624915953509_920_h2.jpg)