|

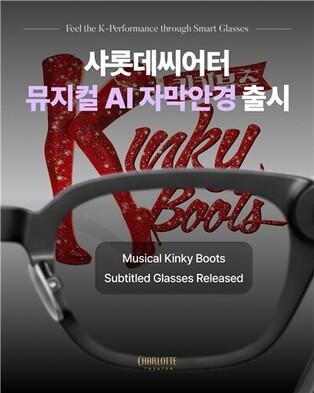

| ▲ An electronic signboard at a Hana Bank in Seoul shows the benchmark Korea Composite Stock Price Index having jumped 134.03 points, or 5.66 percent, to 2,502.37 on Nov. 6, 2023, the first day of the implementation of a ban on short selling that is set to continue until the second half of the following year to combat illegal short selling by global investment banks. (Yonhap) |

(LEAD) stocks-summary

(LEAD) Seoul shares bask in record daily advance after short selling ban

(ATTN: CHANGES headline, lead, photo; ADDS bond yields at bottom)

SEOUL, Nov. 6 (Yonhap) -- South Korean stocks surged by the sharpest-ever rise of 5.6 percent Monday as the country reimposed a ban on stock short selling to crack down on illegal market practices by global investment banks. The local currency sharply rose against the greenback.

The benchmark Korea Composite Stock Price Index (KOSPI) soared 134.03 points, or 5.66 percent, to close at 2,502.37, extending its winning streak to a fourth day. Tech and battery-related stocks led the overall market advance.

Trading volume was high at 518.4 million shares worth 14.94 trillion won (US$11.5 billion), with gainers outnumbering losers 743 to 149.

On Sunday, the country's financial regulators announced the ban on stock short selling, effective starting Monday through the end of June 2024, citing concerns about growing market volatility and the illegal short selling practices undermining market stability.

In a meeting with reporters earlier in the day, Lee Bok-hyun, head of the Financial Supervisory Service, reiterated the need to temporarily ban stock short selling, saying the measure is aimed at restoring a level playing field for retail investors.

Kim Dae-jun, an analyst at Korea Investment & Securities, said the local stock market may continue to rise as investors are tempted to hold shares.

Local stocks also apparently benefited from the latest U.S. employment data released Friday, which showed an uptick in unemployment, reinforcing hopes that the U.S. Federal Reserve may end its interest rate hike campaign, according to market watchers.

In Seoul, battery, tech and auto stocks led the overall gains, with top steelmaker POSCO Holdings surging 19.18 percent to 522,000 won and leading battery company LG Energy Solution climbing 22.76 percent to 493,500 won.

Chemical and energy shares also chalked up strong gains, with chemical giant LG Chem increasing 10.62 percent to 521,000 won and major oil refiner SK Innovation adding 13.42 percent to finish at 155,500 won.

Tech stock also fared better, with Samsung Electronics rising 1.87 percent to 70,900 won and LG Electronics adding 3.85 percent to end at 105,300 won.

Leading carmaker Hyundai Motor rose 2.6 percent to 177,900 won, and its smaller affiliate Kia added 1.8 percent to finish at 79,000 won. Auto parts maker Hyundai Mobis moved up 4.59 percent to 228,000 won.

The local currency ended at 1,297.30 won against the U.S. dollar, up 25.10 won from the previous session's close, the strongest in three months.

Bond prices, which move inversely to yields, closed higher. The yield on three-year Treasurys decreased 7.2 basis points to 3.877 percent, and the return on the benchmark five-year government bonds fell 6.7 basis points to 3.954 percent.

(END)

(C) Yonhap News Agency. All Rights Reserved