banks-household loans

Banks' household loans shrink at fastest clip in Jan. amid high borrowing costs

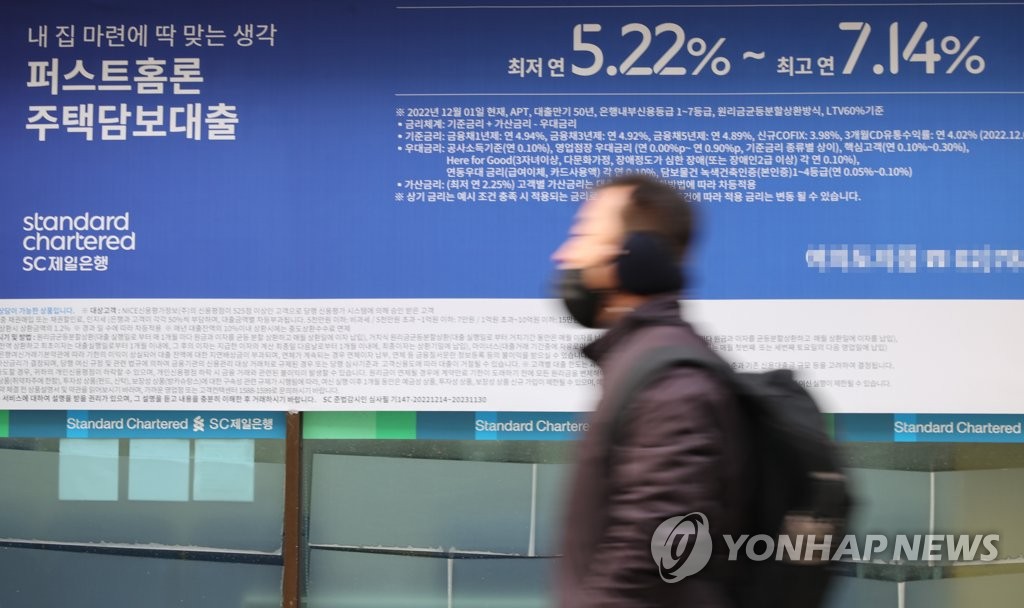

SEOUL, Feb. 9 (Yonhap) -- Household loans extended by South Korean banks shrank at the fastest rate in January due to high borrowing costs resulting from the central bank's monetary tightening measures aimed at controlling inflation, data showed Thursday.

Banks' outstanding household loans came to 1,053.4 trillion won (US$835.04 billion) as of end-January, down 4.6 trillion won from a month earlier, according to the data from the Bank of Korea (BOK).

This marked the sharpest contraction since January 2004 when data started being compiled.

The decline came as the BOK has pushed for a series of rate increases to bring inflation under control, driving up borrowing costs at local banks.

Last month, the central bank hiked the benchmark interest rate from 3.25 percent to 3.5 percent, the highest level since late 2008. It marked the seventh straight rate increase since April last year, the longest span of tightening.

Banks' outstanding home-backed loans stayed unchanged at 798.8 trillion won as of end-January.

Their unsecured and other types of loans to households, meanwhile, shrank 4.6 trillion won on-month to 253.2 trillion won, which represented the second sharpest drop ever.

Banks' corporate lending increased as companies took out loans for tax payment and business operations.

Corporate loans came to 1,178.2 trillion won as of end-January up 7.9 trillion won from a month earlier, the data showed. The increase followed a decline of 9.4 trillion won in December.

(END)

(C) Yonhap News Agency. All Rights Reserved

![[가요소식] 베이비몬스터,](/news/data/20251219/yna1065624915960276_172_h2.jpg)